What is research and development tax relief?

Last week we attended the Leicestershire Business Festival and sat in on a lecture about a subject we know well, Research and Development (R&D) tax relief.

It seems that with 50,000 claims made annually, more and more SMEs are becoming aware of their opportunity to make a claim for this research and development tax relief under the SME scheme.

With plans to reintroduce the cap on credits from April 2020, now seems like the optimal time for businesses with qualifying projects to make a claim. Read on to find out if you could make a claim.

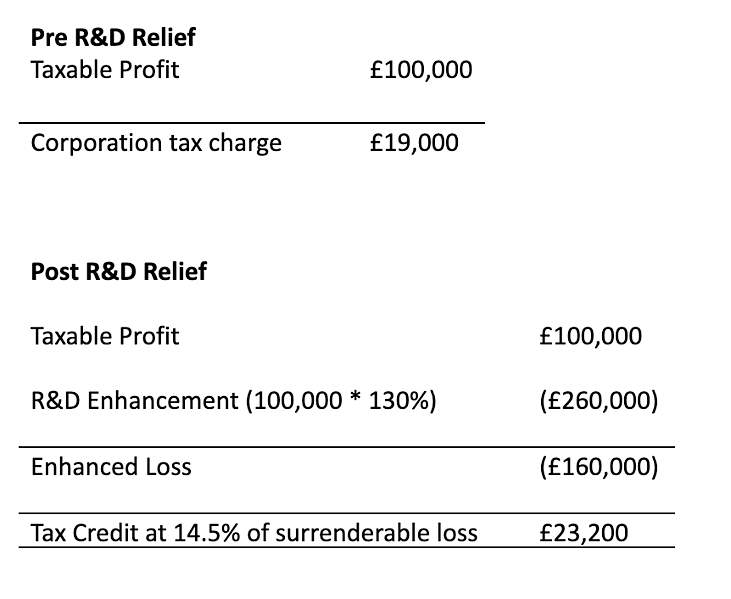

The SME Research & Development tax relief scheme is a claim for relief under Chapter 2 of the Corporation Tax Act 2009. The scheme allows a business with qualifying project costs to enhance their qualifying expenditure by 130% to reduce taxable profit and thus reduce the amount of corporation tax to pay.

In the event that enhancing the expenditure causes a loss, the enhanced loss can be offset against past or future profits, or alternatively, the loss can be surrendered to HMRC in exchange for a tax credit equal to 14.5% of the surrenderable loss.

The research and development scheme is one of, if not the most generous relief schemes available to businesses in the UK.

There are technical criteria you must meet to qualify for SME R&D tax relief under Chapter 2 of the Corporation Tax Act 2009.

You must have the following:

(You will need to include linked and partnership enterprises, if relevant, to accurately arrive at turnover and balance sheet values for the purpose of R&D tax relief).

The largest obstacle to claiming R&D tax relief is the widespread perception that the scheme is only available to big businesses and to people who work in white coats at the cutting edge of science.

The scheme is in fact available to all industries and we have made claims for clients across a variety of sectors including:

If you think you might have a claim, you should speak to a professional advisor like us at Linford Grey. Most specialists in the sector charge nothing for an initial consultation to establish whether you qualify to make a claim under the SME R&D scheme and so there is really nothing to lose and everything to gain.

ABC Ltd has incurred research and development costs on a project that involved designing and fabricating lightweight, durable and cost-effective rigging for the installation of commercial air conditioning.

They incurred £200,000 of qualifying R&D costs and made £100,000 taxable profit in the year.

The above example demonstrates that even modest claims can have significant benefits to UK businesses making a robust and complete claim. Profit that would ordinarily attract a corporation tax liability at 19% can become a significant cash injection.

Research and Development tax relief and tax credits are somewhat underutilised by businesses that mistakenly believe that R&D is only performed in laboratories by big businesses and people with PhDs.

If you are working with specialists to overcome uncertainties that if / when resolved would advance either the knowledge or capability in your industry or otherwise appreciably improve existing products or processes, you will most likely qualify to make a claim and that criteria applies to the independent shopfitter, fashion designer, gin distiller, craft beer brewer, space tech and pharmaceutical company.

Want us to help you find out if you can make a research and development tax relief claim? Get in touch with us today.

Linford Grey Associates. An intelligent friend. A trusted advisor.